Spring 2021 Newsletter

09 April 2021Pre-pack Administration reforms approved by Parliament

New pre-pack regulations were approved by Parliament and will come into force on 30 April 2021. The new regulations provide for sales of business assets to connected parties in Administrations to be scrutinised. In summary, an Administrator will be unable to dispose of all (or a substantial part) of the company’s assets to a person connected with the company within the first 8 weeks of the Administration without either; the approval of creditors or an independent written opinion (positive or negative). The connected party purchaser will be required to obtain a written opinion from an Evaluator. The provider of the opinion must be independent of the connected party purchaser, the company, and the Administrator, and must meet certain eligibility requirements. While the profession has generally welcomed the Government’s efforts to improve stakeholder confidence in pre-packs, there are concerns that this may hamper genuine rescue deals that preserve employment and achieve the best outcome for creditors.

The Coronavirus Job Retention Scheme- HMRC Fraud Team

HMRC has set up a dedicated team to identify and recover funds where the CJRS and other support payments such as the Self-Employed Income Support Scheme and the Eat out to Help Out scheme, were made when they were not properly due.

Cross-class cram down in new restructuring regime

In January the High Court, for the first time, sanctioned a restructuring plan exercising the power to a cross-class cram down of dissenting creditors. In effect this obliges all classes of creditors to accept the restructuring terms offered. The court handed down its order sanctioning three inter-conditional restructuring plans (the restructuring plans) for three subsidiaries of Deep Ocean Group Holding BV (together with all of its subsidiaries). Under s901G of the Companies Act 2006, cross-class cram down is available where the following conditions are met: Condition A: the court is satisfied that, if the compromise or arrangement were to be sanctioned, none of the members of the dissenting class would be any worse off than they would be in the event of the relevant alternative; and Condition B: the compromise or arrangement has been approved by the requisite 75% in value of a class of creditors present and voting who would receive a payment, or have a genuine economic interest in the company, in the event of the relevant alternative.

The Corporate Insolvency and Governance Act 2020 (Coronavirus) (Extension of the Relevant Period) Regs. 2021

The Regulations will come into force on 26 March 2021. They amend a number of provisions within the Corporate Insolvency and Governance Act 2020. The amendments are as follows (1) The suspension of liability for wrongful trading in the UK until 30 June 2021 for directors who continue to trade a company through the pandemic despite the uncertainty that the company may not be able to avoid insolvency in the future. (2). Termination clauses in supply agreements on insolvency are still prohibited - Small suppliers will remain exempted from the obligation to supply until 30 June 2021 (3) The modifications to the new moratorium procedure, which relax the entry requirements to it, will also be extended until 30 September 2021. Thus, a company may enter into a moratorium if they have been subject to an insolvency procedure in the previous 12 months (4) Statutory demands and winding-up petitions will continue to be restricted until 30 June 2021.

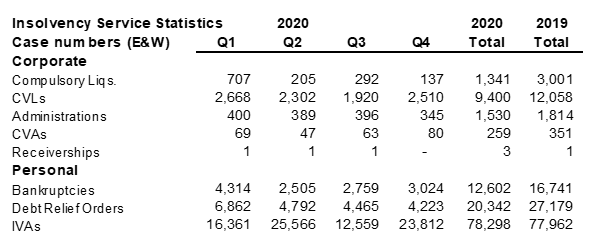

Commentary on the attached statistics

All company insolvency procedures, except administrative receivership appointments (which remain low), decreased from 2019: underlying CVLs decreased by 22%; Compulsory Liquidations fell by 55%; Administrations fell by 16%; and CVAs were 26% lower. The number of CVLs in 2020 was the lowest seen since 2007. Compulsory liquidations and CVAs also dropped to their lowest annual levels since 1973 and 1993 respectively. The reduction in company insolvencies in 2020 as compared to 2019 was likely driven by the range of Government support put in place to support companies in during the coronavirus (COVID-19) pandemic. This includes the Corporate Insolvency and Governance Act 2020 that came into force in June 2020 that introduced temporary measures to help protect businesses during this time of economic uncertainty. These conditions continue into 2021.The reduction in overall individual insolvencies in 2020 is likely to be at least partly driven by Government measures put in place in response to the coronavirus (COVID 19) pandemic, including: (1) Reduced HMRC enforcement activity since the first UK lockdown was applied on the evening of 23 March 2020;(2) Enhanced Government financial support for companies and individuals; and (3) Advice from financial service regulators that individuals and businesses in financial difficulty should be treated with forbearance and due consideration. These conditions will continue into 2021.

Bounce back loan borrowers can delay repayments by an extra six months

On 8 February 2021 HM Treasury announced that businesses that took out government-backed Bounce Back Loans to get through the coronavirus pandemic will now have greater flexibility to repay their loans. Businesses will have following options: (1) Extend the length of the loan from six years to ten. (2) Make interest-only payments for six months, with the option to use this up to three times throughout the loan (3) Pause repayments entirely for up to six months.

Beware of Money Laundering and Distressed Businesses

ICAEW recently published a helpful series of guidance on Anti-Money Laundering, and the final instalment covered businesses in difficulty and how to avoid becoming linked with Economic crime.

In essence, ICAEW is advising accountants (and the same is true of other advisors) to be vigilant to the threat that criminals may target businesses in distress, particularly cash businesses. An established cash-based business is attractive to organised criminals, either to purchase outright or to inject funds into as a means of laundering the Proceeds of Crime. In times of business distress, business owners may not consider the source of funds as they instead focus on securing their business.